296

Saving

One key aspect of financial health is saving. If you spend everything you earn, you limit your financial flexibility. But if you save a little bit each week or month, over time, you will build a cushion. Your savings can help sustain you when unexpected issues arise or in moments when you are unable to earn, for whatever reason. You can save at a variety of institutions.

Comparing Institutions

When you decide to open an account, consider the type of institution you will use:

- Banks are for-profit financial institutions open to anyone. Accounts in banks are insured for up to $250,000 by the Federal Deposit Insurance Corporation (FDIC).

- Credit unions are not-for-profit financial institutions run to benefit a specific group of people (for example, teachers, health-care workers, or military families). Accounts in credit unions are insured for up to $250,000 by the National Credit Union Administration (NCUA).

- Investment firms (and banks) often offer bonds, CD’s, and money-market investments as an alternative to a low-interest savings account. However, your money can be restricted from access for a period of time.

Comparing Accounts

Both banks and credit unions offer two basic types of accounts:

- Savings accounts are set up for saving money, so they typically offer a modest interest rate and may restrict access to funds.

- Checking accounts are set up to make money easily accessible through checks or debit cards, but they typically offer little or no interest and may charge a fee.

When you are shopping for the best account, think about the following issues:

- Is a minimum balance required to open and maintain the account?

- Are there any fees involved in maintaining the account?

- What interest rate, if any, does the account offer?

- What restrictions apply to accessing your money?

- What possible penalties are attached to the account?

Managing Accounts

Usually, you can manage your accounts online, on the phone, or in person. You can deposit funds into an account, withdraw funds from an account, transfer funds between accounts, and check the balance. It is important to track all transactions in an account register and check it once a month against the statement you receive by mail or online.

Your Turn Go online to investigate savings options. Write a journal reflection about the best savings options for you, and indicate why you chose as you did.

297

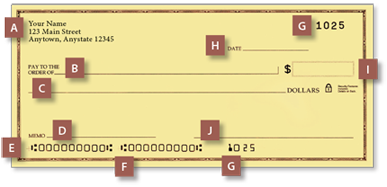

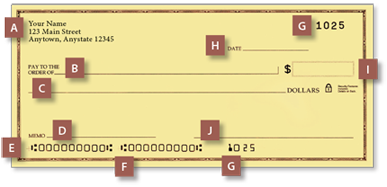

Using Checks

When you open a checking account, you’ll be given a few checks, but you will need to order more if you plan on using them as your primary way to pay. When you write a check, you must have enough money in your account to cover it. The best way to be sure of this is to keep a check registry, listing all the checks you have written and all the deposits you have made. Here are the main features of a check:

A Person paying the money

B Person or business receiving the money

C Amount of money written in words

D Reason for payment (optional)

E Bank routing number

F Checking account number

G Check number

H Date when check can be cashed

I Amount of money in digits

J Signature of person paying

Using ATM/Debit Cards

Most institutions today offer ATM or debit cards with their checking accounts. An ATM (automatic teller machine) card allows you to access your account at machines placed in businesses and throughout the community. Debit cards allow you to pay at most businesses with a direct withdrawal from your account.

Keeping a Register

Whether you write checks or use an ATM or debit card, you should keep track of your transactions. Whenever you make a payment or deposit, write the date, the recipient or source, the reason, and the amount. Then, whenever you need to find out how much you have in the account, you can subtract payments from deposits. You can also check this registry against the statement you receive from your financial institution.

Your Turn Go online to investigate banks near you to find out whether they offer checks, ATM cards, or debit cards. Write a journal reflection about which option you would prefer and why.