298

Purchasing

Of course, the reason to make money is to have purchasing power—the ability to buy the things you need or want. All of us have a common set of needs, as identified by Abraham Maslow. Money helps you get the water, food, clothing, and shelter you need to live, as well as the health care and property that improves your standard of living. Money also lets you make purchases that enhance friendships (movie tickets) and family life (a Thanksgiving turkey). As you can see, however, money slowly loses its power as you move up Maslow’s hierarchy. As the Beatles’ famous song puts it, “Money can’t buy me love.”

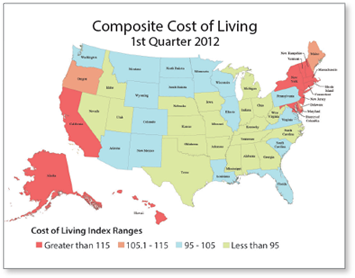

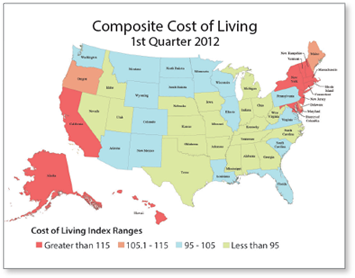

Understanding Cost of Living

The cost of living is the amount of money a person needs to maintain a certain standard of living. Standard of living refers to a specific level of wealth and comfort (for example, working class, middle class, upper class). Different people living in the same city can have vastly different standards of living, and different places in the country can have vastly different costs of living. It’s much more expensive to live in New York City than in a small rural town, for example. Both the cost and the standard of living can vary over time, depending on a variety of economic factors (jobs, income, property values, cost of goods, and so on).

Consumer Price Index

One handy measure of the cost of living is the Consumer Price Index (CPI). The CPI measures the changes over time of the cost of goods and services in metropolitan areas. It takes the following items into account:

- Food—the cost of buying groceries

- Merchandise—the cost of clothing, furniture, cars, and so on

- Housing—the cost of purchasing or renting real estate

- Energy—the price of gasoline, heating oil, natural gas, electricity, and so on

- Services—the cost of haircuts, accountants, health services, and so on

Your Turn Go online to thoughtfullearning.com/h298. There you’ll find a link for calculating the cost of living where you live and the cost of living somewhere else that you would like to live. Write a reflection about the differences.

299

Thinking Critically About Purchases

Have you ever bought something on a whim and regretted it later? Usually the regret is directly proportional to the amount of money you spent. Impulse buying might be fine for small items, but not for large purchases. Consider the following points before spending a significant amount of money:

- Need or want: Distinguish between what you truly need and what you only want. For example, if you need a car to get to work, you don’t necessarily need a new muscle car. A used compact could work. By separating what you need from you want, you can make better decisions about what you buy.

- Quality: Purchase a product or service that is at least adequate in terms of meeting your need or want. For example, needing a car requires a vehicle that is safe, dependable, and affordable. Wanting a car may require one that is red and has a powerful engine.

- Cost: Think about how much money you must pay for the product or service. Know what the usual cost is and what you are willing to pay. If the cost is less, you may have found a deal. If it is more, be wary.

- Alternatives: Consider what other options you have for satisfying the need or want. It may be that you can buy something of higher quality for less money.

- Opportunity cost: Remember that by spending money on something, you no longer have that money to spend on other things. For example, if you finance a car, the down payment is spent, and the continued payments will come from your budget each month.

Researching Products and Services

In order to truly understand the alternatives available to you, you can create a comparison grid like the one below. In the left column, list alternative purchase possibilities. In the top row, list the features you want from the product or service. Then do your research and fill in the chart.

Used Cars | Age | Mileage | MPG (city/hwy) | Color | Price |

Ford Focus | 8 yrs | 125,957 | 26/33 | Red | $5,493 |

Chevy Cobalt | 5 yrs | 77,408 | 22/31 | Blue | $6,896 |

Toyota Camry | 9 yrs | 81,140 | 23/32 | Black | $8,990 |

Your Turn Imagine you are planning to buy a car to get to work or go to college. Think first about whether you actually need or just want a vehicle. Consider quality and cost (go to Kelley Blue Book at kbb.com). Then search online for cars for sale. Create a comparison grid to list the cars that most interest you. Which would you choose, and why?

300

Leasing and Buying

More-expensive items such as cars, apartments, and houses can be leased (rented) or owned. Each option has its own conditions.

Leasing

When you lease or rent something, you pay money on a routine basis for the use of someone else’s property.

- Lessee’s responsibility: The person paying rent is provided exclusive use of the property but must return the property in fair condition. Those who lease vehicles are often required to pay for maintenance as well.

- Lessor’s responsibility: The person who owns the property must allow the lessee exclusive use of the property for the specified period. For real estate (apartments and houses), the owner usually performs routine maintenance.

- Contract: Renting involves a contract that grants the renter use of the vehicle or space for a specific purpose and period of time, with exact terms.

- Security deposit: Renting usually requires the renter to provide money up front to cover possible damage to the property. When checking into a hotel, for example, you have to provide a credit card up front. When renting an apartment, you often pay a deposit that will be refunded if you leave the property undamaged.

- First month’s rent: Often the owner of the property will require you to pay the first month’s rent before you move in.

- Leasing with option to buy: This arrangement, common with leased automobiles, asks the lessee to pay more money up front but less money per month than an outright purchase would require. At the end of a specified period, the lessee can opt to purchase the property.

Buying

When you buy something, ownership transfers from one person to another. The receipt you receive is a record of this transaction, showing what you paid and what you received. If you want to return something you bought, you need to bring the receipt to undo the transaction. Buying often includes other documents:

- A guarantee indicates that the item purchased is free of defects and is what the manufacturer purports it to be.

- A warranty indicates that the item purchased will work correctly for a specified period of time or be repaired or replaced by the seller.

Note: Always read the fine print of these documents so you know exactly what you are getting.

Your Turn Select one of the cars that you considered in your comparison grid on the previous page. Research any leasing options available for the vehicle. Examine the guarantee or warranty that is included with the vehicle’s purchase. How would this information affect your decision to either lease or buy the car?

301

Understanding Payment Plans

Sellers want to make it easy for you to buy, so they often provide payment options:

- Prepayment allows you to reserve an in-demand item such as the latest novel by a popular author or the newest game release for a popular title. You can also prepay on a gift card or for cell-phone minutes.

- Pay at purchase refers to buying something online or at the checkout counter. You provide money and take possession of the product or service.

- Layaway means that you make a down payment on something, and the seller holds on to the item until you can pay the rest of the cost. There is often a charge for using a layaway service. If you don’t make all of the payments, your money will be returned except for the initial charge.

- Installments allow you to pay for something in portions—perhaps a third down, a third the next month, and the final third the month after that. However, you can take the item with you after you sign the installment plan and make the first payment.

- Rent to own allows you to take the item and make regular rental payments on it, which slowly accumulate until you have paid a specified amount (usually much more than the regular price).

- Billing allows you to purchase a product or service and pay for it later when you get the bill. Most utilities work this way, as do services such as plumbing contractors or health-care providers.

- Credit purchases are paid for by a third party, whom you pay back. For more information about credit, see page 303.

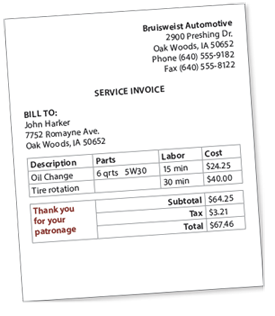

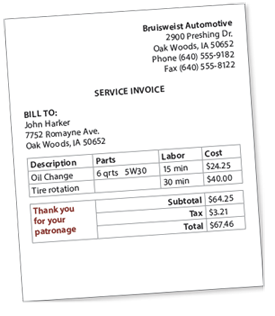

Receiving and Paying Bills

If you are being billed for a product or service, you will receive a bill either in the mail or by email. The bill will indicate what product or service you received, the date of purchase, the total cost, the amount you have paid, the amount you owe, and the due date. By keeping up with your bills, you can avoid late fees and penalties.

Using Customer Service

If you have questions or concerns about a purchase, you can take the issue to the customer service department of the business involved. This service may be automated or person to person.

Your Turn Go to a local store and show this page to a customer service representative. Ask the person which payment options explained above are offered by his or her store.