293

Earning

Doing chores for your parents or neighbors and being paid for it might be the first job you’ll have. The money you earn is handed to you, and that’s that. Once you start working for a formal business, however, earning income gets a little more complicated.

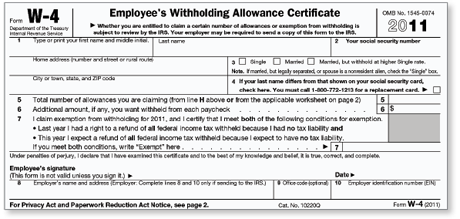

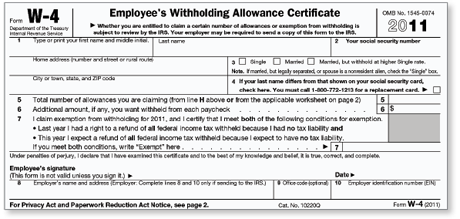

W-4 Form

You’ll start by filling out a W-4 form, which tells your employer how much of your pay to withhold for tax purposes. (The form includes worksheets to help you make these calculations.) “Allowances” in line 5 refers to the number of dependents (spouse and children) you have.

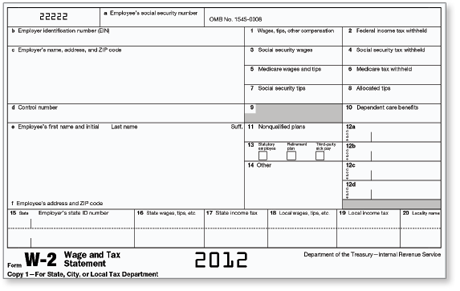

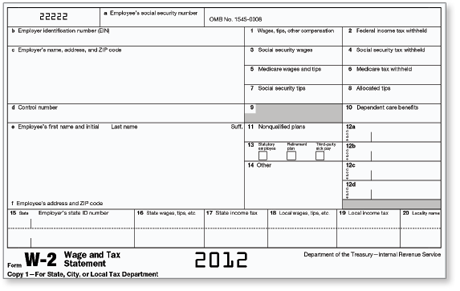

W-2 Form

At the end of each year, your employer will provide you with a W-2 form that shows how much you earned in the year. This is the amount reported to federal and state governments and by you on your tax forms. Earned income includes wages, salary, tips, commissions, and other compensation.

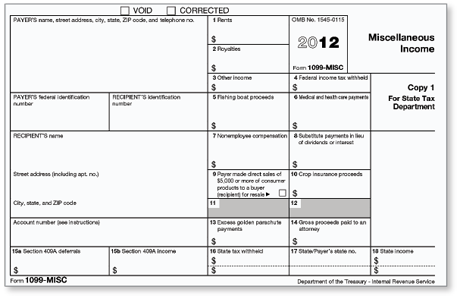

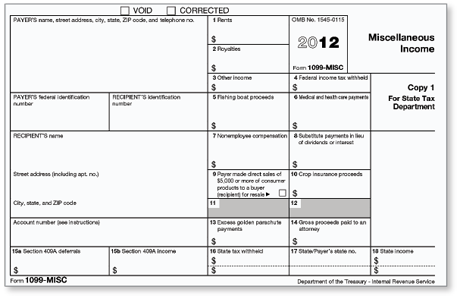

1099 Form

If you have income from royalties, interest, or dividends, the company or organization that pays you this will report it on a 1099 form. You’ll have to include that income as well on your tax forms.

Your Turn Search for the W-4 form online at irs.gov, download a copy, and fill it out for practice.

294

Understanding Benefits

In addition to receiving money for your work, you might receive other benefits as well. These benefits are part of an overall compensation package—a way that employers compete for good employees. Sometimes the employer will pay the total cost of these benefits, but other times you may be required to pay part of the cost in the form of a deduction from your pay. Here are some types of benefits that may be offered.

- Insurance: If you work full-time (usually 30 or more hours a week), your employer may offer an insurance package that costs less than what you could purchase on your own. The package may include medical, dental, vision, disability, and life components. (See page 309.)

- Retirement: For full-time employees, many employers offer retirement-savings options such as 401(k)s, IRAs (individual retirement accounts), or pensions. Often these plans offer tax benefits. Talk to a financial advisor or tax accountant to learn more about the tax benefits.

- Profit sharing: Some employers reward employees by giving them a share of the business’s profits. When the company benefits, the workers do as well.

- Paid time off: Full-time employees often receive paid time off for vacations, holidays, sick days, and bereavement (time off for a loss in the family).

- Unpaid leave: Full-time employees may also be allowed to take time off without pay.

- Day care: Some employers who want to retain employees with young children offer a child-care benefit or even on-site child care to help working parents.

- Housing: If you work at a remote location (such as a summer camp or an archaeological dig site), you may be provided with on-site housing so that you can do your job.

- Meals: If you work in a remote location (such as on a fishing boat or an Army base), or if your employer wants to encourage you to stay on-site during mealtime, you may be given meals.

Benefits like those explained above can make a lower wage more acceptable, but remember that employers can change the benefits they offer at any time. Consider all the factors of a job when making your choice—the work, pay, and benefits.

Your Turn Think of a job that you would like to do now or after you graduate. Search online to find out how much the job typically pays and what benefits come with it. Then search specific employers in that field and choose one that offers a strong compensation package. Write a journal reflection, imagining yourself working for the employer.

295

Paying Taxes

You’ve probably heard the old saying “Nothing is certain except death and taxes.” To put a positive spin on it, if you’re paying taxes, at least you’re still alive. Your taxes pay for the many government services you receive, from paved roads to public education to firefighters to Social Security and national defense. Some taxes are deducted from your paycheck, while others are paid directly by you.

Deducted Taxes in the United States

- Federal income tax: Income tax provides the federal government with its largest source of funds—about 42 percent of total revenues.

- State income tax: Income tax provides the state government with its main source of revenue.

- FICA: This tax (Federal Insurance Contributions Act) is your payment into the Social Security system.

- Medicare: This tax supports the Medicare system, which currently provides medical insurance to U.S. citizens 65 years or older as well as to individuals receiving Social Security Disability Insurance.

- Medicaid: This tax supports the Medicaid program, which currently provides medical insurance for people who receive certain government benefits—including people who are over age 65 or are disabled and receive Supplemental Security Income (SSI) from Social Security.

- Unemployment tax: This tax pays into an insurance system for those who lose their jobs.

Other Taxes in the United States

- Property tax: Property tax is usually assessed by local governments to fund services such as schools and garbage collection. It is paid by anyone who owns real estate.

- Sales tax: This tax is usually assessed by states on most nonfood items purchased within the state.

- Excise tax: This tax is usually assessed by federal and state governments on specific products. “Sin taxes” on items such as tobacco and alcohol are meant to discourage their use. A “user fee,” such as the tax on gasoline, is applied to some connected cost, in this case building and repairing roads.

Your Turn Go to thoughtfullearning.com/h295 for a link to activities on the IRS Web site. These activities will help you understand the taxes you pay to the federal government.